Airswift has merged with Competentia

June 21, 2021

- Home

- News

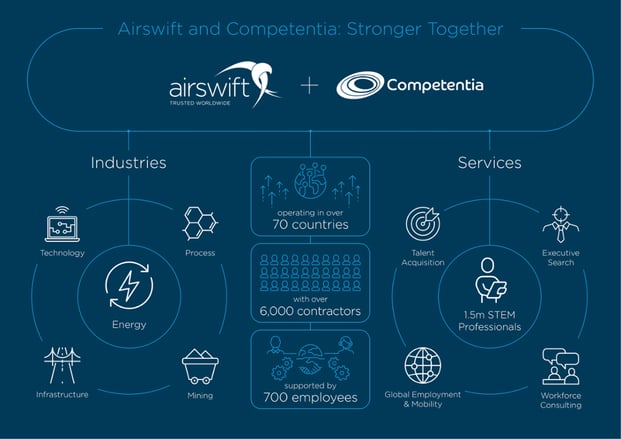

We are proud to announce that we have merged with global recruiting and workforce management specialist, Competentia. Together, we form one of the world’s most forward-thinking workforce solutions providers serving the energy, process, infrastructure, mining and technology industries.

About Competentia

Established in 1998, Competentia provides services in more than 40 countries across five continents. It has over a thousand contractors deployed on global projects, supported by local teams in North America, Europe, Africa, the Middle East and Asia, and has provided staffing, payroll and global mobility services to some of the biggest technical employers in the world.

Bringing together our high-performing cultures and strong ambition

The combined entity, which retains the Airswift name, brings together our high-performing cultures and shared ambition for the future. The merger means we are among the world’s largest energy and wider engineering workforce solutions providers, offering clients access to deep talent pools in countries across the globe. Together, we have the biggest market share in the Americas and APAC regions, along with a strong presence in the Nordics.

We are the only global energy workforce solutions provider built to help organisations respond to new ways of working and grow in the rapidly digitising, post-pandemic world. We have an unrivalled candidate database, giving businesses access to the top technical talents across the industries we serve.

Competentia shares our focus on continual improvement and ambition to offer the best possible workforce solutions to our clients, contractors and candidates. We have a strong ambition to support our growth with industry-leading systems, digital tools, data analytics and disruptive technologies that will give our clients the tools they need to succeed.

Airswift chairman Ian Langley initiated the discussions to merge with Competentia. He said: “It was obvious from our opening call that a potential merger had great merit. We found that our organisations had similar cultures and aspirations, and we quickly discovered a unique alignment.”

New opportunities for clients and employees

With our combined size and experience, coupled with our determination to continually improve and focus on the energy transition, we can help our clients navigate the complex workforce challenges to come post-pandemic. In addition, our candidates will have more opportunities to build their careers in a more flexible way due to our broader level of services.

Our clients will now have access to an enhanced database of candidates, with a wider talent pool and greater depth of engineering and technology knowledge. As a more fully integrated workforce solutions provider, we can offer a higher level of consultative service across a wide range of locations; we will be strengthening our teams, processes and technologies across all of our local offices.

For employees, we are now able to increase opportunities for specilisation and provide opportunities to learn from exposure to a wider range of companies and challenges, as well as enhanced opportunities for global mobility. Employees coming from Competentia will have access to improved training, learning and development programmes and clearly defined career tracks.

This larger organisation structure will offer access to more role opportunities for contractors, as well as to new markets, service lines, projects and clients.

A smooth transition

Our experienced management team has successfully completed complex mergers in the past, such as between Air Energi and Swift, and between Competentia and Link Oil & Gas Professionals and Dare Energy.

The shared vision and values between our teams will make for a smooth transition and we are particularly proud of our shared focus on service and employee wellbeing.

Our first priority will be to make sure that everyone is treated with fairness and respect; we will manage the transition as quickly as possible, providing transparent communication throughout the process.

We strive to work hard to replicate our shared best working practices and technologies across the entire organisation.

Key takeaway

This merger opens the door for blue-chip and mid-market companies to gain access to an even broader range of integrated solutions:

- Talent acquisition

- Professional search

- International contractor management

- Global Employment Outsourcing

- Consultancy

- Payroll management

Our candidates will also have access to a wider range of global jobs in the engineering and technology sectors

This post was written by: Maegan Toups

You may also be interested in…

-

Airswift's Relay For Life raises over $80k globally for cancer charities

-

GETI 2024: Energy workers say AI will drive demand for human skills

-

Janette Marx becomes Airswift CEO

-

Airswift named The Energy Recruitment Company of the Year and The Best Large Recruitment Company to Work For at TIARAs

-

Airswift exhibit at Nuclear Decommissioning Authority event in UK

-

Airswift payroll team shortlisted for Global Payroll Award

-

Demand for energy workers surge, in spite of warnings that Australia could fall behind on clean energy industries

-

Green jobs for all: The tech workforce is greening up to meet net zero targets

-

Airswift launches new Aberdeen office

-

Winners at The Global Recruiter Asia Pacific Industry Awards 2018